(Peoples Daily Online)11:07, January 13, 2021

Faced with the impact and challenges caused by the COVID-19 pandemic, Chinas Internet marketing not only showed great resilience, but also provided a basic guarantee for fighting the pandemic, resuming production and boosting the real economy, says a report released on Jan.12, 2021.

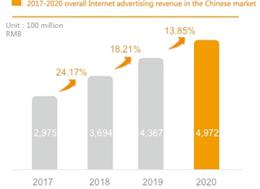

The China Internet Advertising Data Report says in 2020, Chinas Internet advertising achieved advertising revenue of 497.2 billion yuan (excluding Hong Kong SAR, Macao SAR and Taiwan province), maintaining an annual growth rate of 13.85 percent, which was 4.35 percentage points lower than the previous year.

The entry of small, micro and cutting-edge advertisers has not only filled the market share, as a result of big brands’ investment slowdown, but also supported the double-digit growth of the Internet advertising market, opening up a new path in the local era for the real economy’s recovery.

In 2020, the tendency that Chinas Internet marketing extended from advertising to services was more obvious. The total scale of the market for Chinas Internet marketing reached 1.05 trillion yuan. The revenue of Internet marketing services (excluding advertising) reached 549.4 billion yuan, which has exceeded Internet advertising revenue. With the continuous innovation of Internet marketing models, Internet marketing services have shown diversified growth, which has blazed a path for China to drive the real economy growth.

Compared with 2019, the advertising investment costs of small, micro and cutting-edge brand advertisers in 2020 increased by 50 percent, 5 percentage points higher than that of mature brands. Small and micro, cutting-edge advertisers have become a new force supporting the Internet advertising market in 2020.

Video platforms grew the fastest in 2020, an increase of 64.91 percent from 54.8 billion yuan in 2019 to 90.4 billion yuan. Among them, short video ads are the most eye-catching, with an increase of 106 percent, far exceeding the 25 percent increase of long video ads.

In 2020, Internet advertising on e-commerce platforms increased by 17.26 percent, and its share increased slightly from 2019 to 37 percent. E-commerce live stream marketing has become an important channel for retail digitization and e-commerce breakthrough. According to statistics, in the first half of 2020 there were more than 10 million e-commerce live streaming sessions, more than 400,000 active anchors, more than 50 billion viewers, with over 20 million products hitting the store shelves. The focus of live stream marketing has shifted from the sale of commodities to the emotional connection of people.

In 2020, consumer demand for various industries showed different flexibility with the pandemic. Under the pandemic situation, consumers demand for education and medical care was strong. Therefore, the advertising growth of these two industries was the most significant, reaching 57.1 percent and 40.28 percent respectively. In contrast, financial insurance, tourism, entertainment and leisure saw a decrease of 46.43 percent and 28.65 percent respectively.

It is believed that in the first year of the 14th Five-Year Plan,” in the context of normalization of pandemic prevention and control, industry insiders should give full play to the innovative advantages of Internet marketing, jointly maintain a good market ecosystem, and create a fair and competitive market environment, in order to move forward steadily amidst uncertain factors, serving the development of the real economy.

The report, which has been released for five consecutive years, was jointly released by the Interactive Marketing Lab in Zhongguancun in conjunction with PricewaterhouseCoopers, Miaozhen Marketing Science Academy and College of Journalism and Communication of Beijing Normal University.

![]()